On August 16 the rupee moved in a tight range and settled just 1 paisa lower at 83.95 against the American currency.

The Indian rupee appreciated 11 paise to 83.84 against the U.S. dollar in early trade on Monday (August 19, 2024), mirroring a positive momentum in domestic equities and fresh foreign fund inflows.

Forex traders said the weakening of the American currency in the overseas market and retreating crude oil prices also supported investor sentiments.

At the interbank foreign exchange, the rupee opened at 83.88 against the greenback, then gained ground and touched 83.84, registering a gain of 11 paise over its previous close.

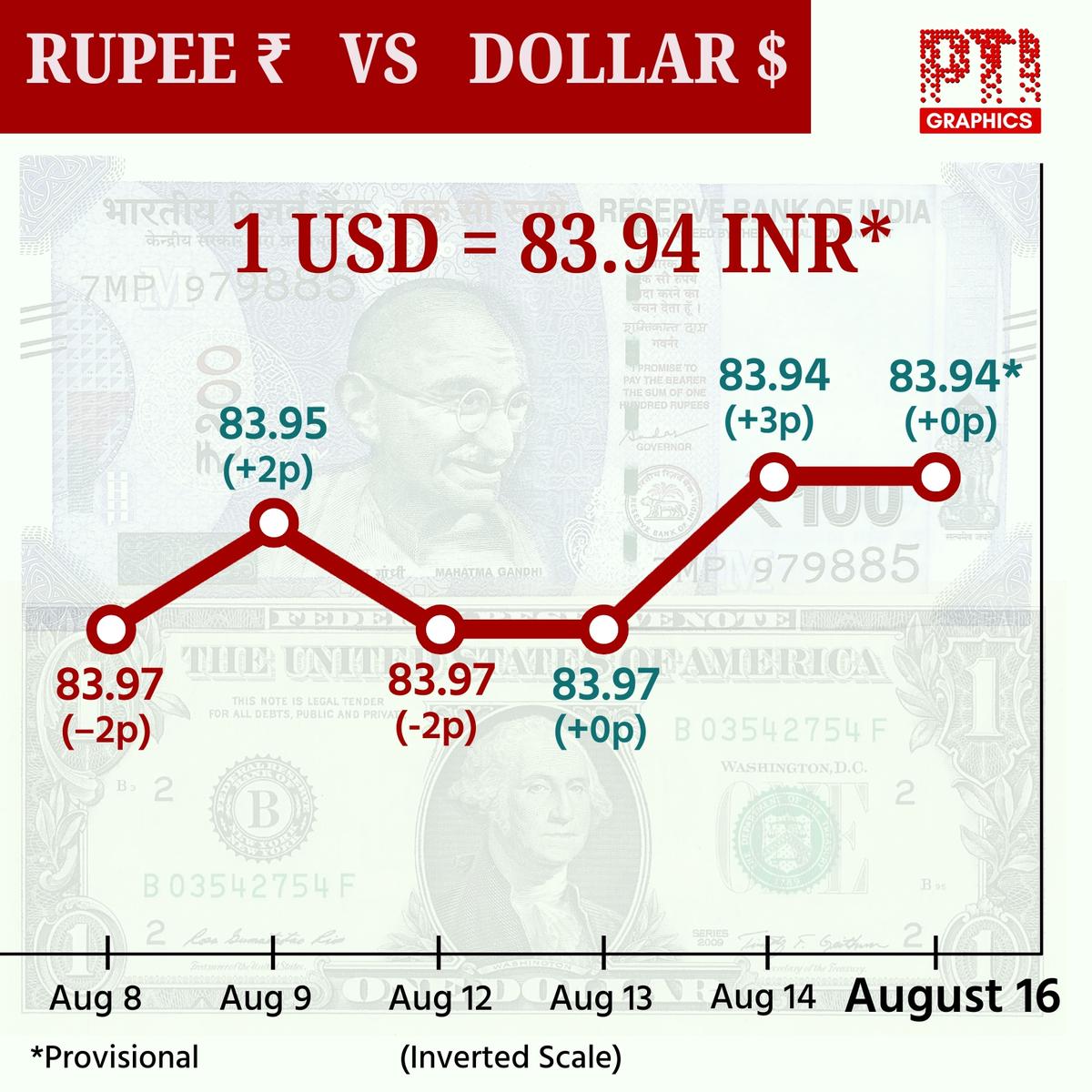

On Friday (August 16, 2024), the rupee moved in a tight range and settled just 1 paisa lower at 83.95 against the American currency.

Over the past shortened week, the rupee showed minimal fluctuation and narrowly steered clear of the critical 84 mark.

“The rupee emerged as the least volatile among its peer currencies, a testament to the RBI’s decisive actions, which were further reflected in the nearly $5 billion dip in India’s Forex reserves from the record high of $675 billion,” CR Forex Advisors MD Amit Pabari said.

Mr. Pabari further said that in the near term, while the RBI may cap the rupee’s decline near the 84 level, significant appreciation also seems unlikely. “This outlook is influenced by India’s widening trade deficit, which has ballooned to $23.5 billion, driven by a surge in oil imports and sluggish export growth,” he said.

This week, all eyes are on the Jackson Hole meeting, where global central bankers will gather for their annual conference. The spotlight will be on U.S. Federal Reserve Chairman Jerome Powell’s speech, as markets eagerly await insights into the Fed’s monetary policy outlook, Mr. Pabari said.

Meanwhile, the dollar index, which gauges the greenback’s strength against a basket of six currencies, was trading lower by 0.26% to 102.19.

Brent crude, the global oil benchmark, declined 0.19% to $79.53 per barrel.

On the domestic equity market front, Sensex advanced 116.78 points, or 0.15%, to 80,553.62 points. The Nifty rose 68.35 points, or 0.28%, to 24,609.50 points.

Foreign institutional investors (FIIs) were net buyers in the capital markets on Friday, as they purchased shares worth ₹766.52 crore, according to exchange data.

Meanwhile, India’s Forex reserves dropped by $4.8 billion to $670.119 billion for the week ended August 9, the Reserve Bank of India said on Friday. In the previous reporting week, the kitty jumped by $7.533 billion to an all-time high of $674.919 billion.