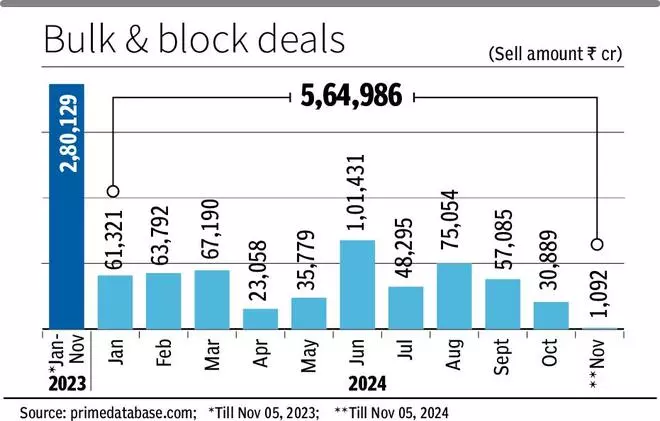

The relentless selling by foreign portfolio investors in Indian equities has not deterred promoters, private equity investors and other investors from monetising their stakes in companies and sell-downs through bulk and block deals have doubled in 2024 year to date at over $67 billion.

In the same period last year, sell-downs aggregated to a little over $33 billion, data from Primedatabase.com showed.

The number of deals have also increased in 2024 to over 23,000 from about 14,366 deals year ago

Certain months have shown a spike in block and bulk deals coinciding with the rally in the stock markets.

For instance June saw a huge surge in sell-downs the value spiking to over ₹ 1 lakh crore, and after a dip in July to ₹48,295 crore, flared up again in August to around ₹75,000 crore. However the accelerated selling by foreign investors and volatility in the stock markets kept the deal volumes subdued.

Sell-downs in September fell to ₹57,085 crore and further to ₹30,889 crore in October which saw the most selling by FPIs. In November so far 141 deals worth ₹1,092 crore have taken place.

Over 62 per cent of the deals in terms of value were transacted in the first half of the year from over 12,400 deals. The second half of the year has seen fewer deals because of the fall in the stock markets and depreciation in valuations.

While bulk of the selling has been led by PE firms and strategic investors who were looking to take some money off the table, promoters have also been busy paring stakes, to raise funds either for philanthropic activities, to retire debt or invest in new ventures.

A few multinationals have also divested stake in their Indian subsidiaries to deal with their own debt issues back home such as BAT Plc selling stake in its Indian arm ITC Ltd, Vodafone Group selling stake in Indus Towers, Whirlpool selling 24 per cent stake in its Indian unit and Sumitomo Wiring selling a small stake in Samvardhana Motherson.