Gold exchange traded fund has been gaining traction among both investors and physical gold jewellery buyers even as the prices have been increasing steadily.

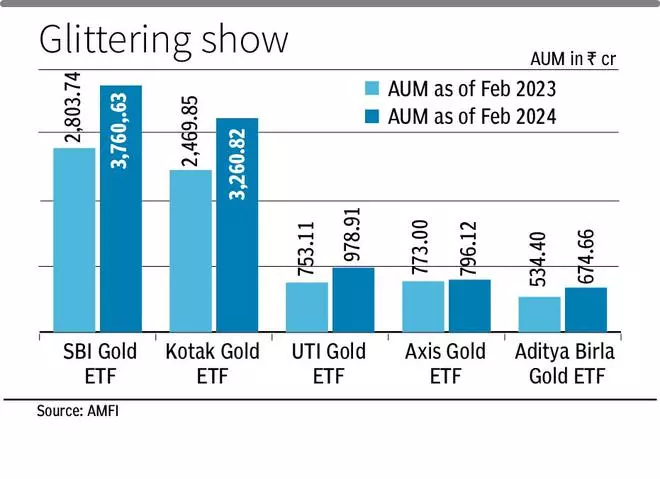

The asset under management of gold ETF has gone up 33 per cent to ₹28,530 crore as of February against ₹21,400 crore in February, 2023.

The AUM of Nippon Gold BeeS has increased 24 per cent as of February to ₹8,929 crore against ₹7,203 crore in same period last year while ICICI MF and HDFC Gold ETF assets were up at ₹4,946 crore (₹3,152 crore) and ₹4,118 crore (₹3,353 crore).

With the concern of high equity valuation, investors are chasing gold ETF as many analysts have been predicting that gold prices will touch ₹1 lakh per 10 gram with the turbulence in the global economy and geopolitical issues.

The industry has delivered return of 12 per cent in last one year and 14 per cent in 3 years. Nippon Gold BeeS, the early entrant and largest in this category, has delivered a return of 15 per cent in last six months and 11 per cent in one year.

The yellow metal prices have breached the ₹70,000-market aided by the bullish trend in the global markets. In last one month, gold prices have increased 9 per cent to touch ₹71,507 per 10 grams on Monday from ₹65,646 on March 11.

Scaling new highs

Sriram BKR, Senior Investment Strategist, Geojit Financial Services said gold prices in the US have been scaling new highs since the start of this year and has surpassed $2,300 an ounce on Monday.

The net inflow into gold ETF has zoomed over five times to ₹4,875 crore in 11 months of this fiscal compared to FY23, he said. The sharp rise in gold prices has almost washed out physical gold jewellery and buyers have been parking their money in exchange traded funds tracking international gold prices.

Just like buying any other equity shares, physical gold buyers can acquire gold ETF through their stock brokers and hold them in the demat account. The sheer convenience has attracted many jewellery buyers to park their money in gold ETFs as they wait for prices to come down.

- Also read:Senco Gold: What investors should do?

Vikram Dhawan, Fund Manager and Head – Commodities, Nippon India Mutual Fund said gold is a real liquid asset that offers a store of value and provides diversification against economic, geopolitical and market turmoil.

Gold ETFs provide better liquidity than the underlying physical market and are convenient, safe and cost-effective way of holding precious metal, he added.