Mahindra Logistics (ML) is an integrated end-to-end logistics solutions and people transport solutions company. It serves over 300 corporate customers spread across industries such as automotives, FMCG, pharmaceuticals and e-commerce. Operating an asset-light model where the vehicles and warehouses necessary for operations are rented or leased through an extensive network of business partners, ML focuses on providing customised and technology-enabled solutions.

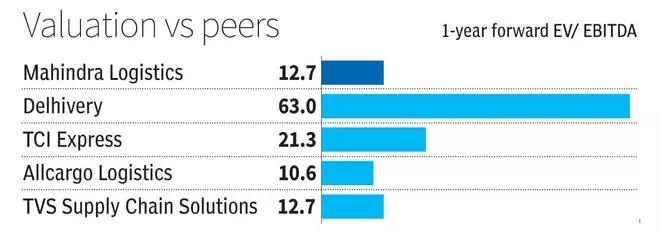

The shares of ML have rallied around 35 per cent since bl.portfolio’s last recommendation in May 2023, to accumulate on dips. The rally could be attributed to a catch-up to sectoral valuations and strengthening fundamentals. At a one-year forward EV/Revenue and EV/EBITDA of 0.7 times and of 12.7 times respectively, the company appears to be reasonably valued at current levels, compared with its peers and when considering long-term growth prospects.

The presence of a strong anchor customer in the form of Mahindra and Mahindra group, which adds up to around 50-55 per cent of ML’s topline, continues to aid the company in having a strong base to build upon. Considering that along with reasonable valuations, disciplined drive towards cost optimisation, formalisation of the Indian economy, increased penetration of GST tilting the scale towards organised players in a widely-unorganised industry we recommend long-term investors to accumulate on dips from here, for a proxy play on the consumption boom in one of the world’s largest consumption markets.

Business segments

ML has two broad segments — Supply Chain Management (SCM) and Mobility.

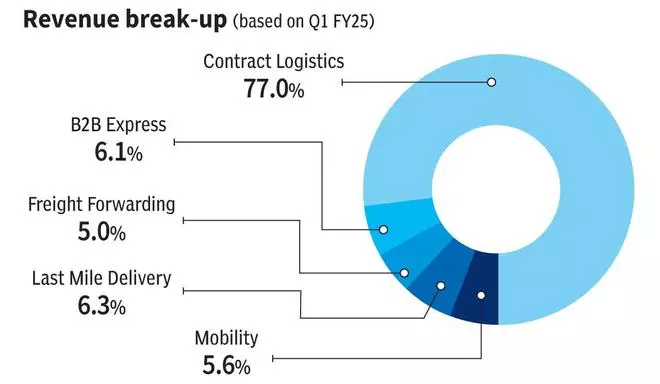

SCM has historically been and continues to be the largest segment, contributing to around 95 per cent of the topline, broadly housing third-party contract logistics (3PL), B2B express, freight forwarding and last-mile delivery (LMD).

Within SCM, the 3PL segment contributed to around 77 per cent of ML’s revenue in Q1 FY25, while B2B express, freight forwarding and LMD segments contributed around 5-6 per cent each.

The mobility segment of the company, contributing to the remaining 5 per cent of ML’s revenue, deals with tech-enabled people transportation solutions and services including enterprise mobility solutions and ride hailing focused on airport and outstation rentals.

Operational metrics

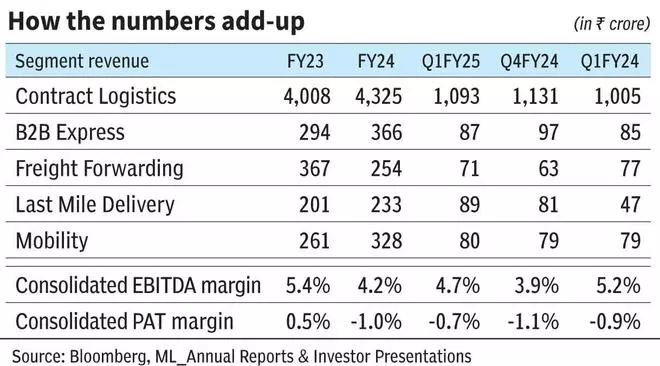

3PL segment de-grew sequentially around 3.4 per cent in Q1, due to labour absenteeism which the management quotes as an industry-prevalent issue, which will be a key monitorable for the coming quarters. However, revenue from the warehousing segment exhibited a solid 14 per cent year-on-year growth in Q1 FY25 indicating greenshoots in the demand environment. This segment is where ML renders integrated supply chain management services namely, inventory management, warehouse management, transportation and distribution, in-factory logistics and value-added services such as packaging, bundling and quality checks.

ML, in October 2022, acquired RIVIGO, which is now integrated and attends the B2B express segment. The acquisition helped ML save years of investment in setting base and this segment, currently, connects over 19,000 pincodes (out of a total of 19,300 pincodes in India) with space under management of around 1.5 million sq ft. This part of the industry catering to, for example, quick delivery of goods between manufacturers and dealers (often sophisticated and multimodal), is dominated by organised players with a market share of around 70 per cent. While integration and cost optimisation were the priorities for the B2B express segment in FY24, the same has shifted to volume growth in FY25. Revenue from this segment dropped 10 per cent quarter on quarter for Q1 FY25, mainly on drop in volumes from existing accounts. EBITDA and PAT continued to be in losses as was in FY24. The management is pushing towards EBITDA-positivity in this segment by Q2 FY25, targeting 10-15 per cent volume gain sequentially in the coming quarters.

Freight forwarding, catering to imports and exports, continues to suffer from pricing pressure since FY24, despite a sequential 12.7 per cent increase in Q1 FY25, though air freight was an exception ducking the trend with sustaining volume growth.

LMD, on the other hand, dealing with micro fulfilment and distribution centres, B2C delivery for enterprise customers in e-commerce and FMCG, and vehicle was a service — leasing integrated fleet of vehicles and adjacent solutions is growing rapidly, albeit on a small base. This is on the back of increasing demand in quick commerce and hyperlocal businesses.

On consolidated levels, EBITDA has improved sequentially despite a drop in topline, underlining ML’s efforts to keep a lid on costs. And volume growth across segments will be a key monitorable to push profitability higher.

While Q1 reflects some short-term bumps in few segments, long-term prospects remain strong.

Business updates

In Q1 FY25, MLL went live with a new three-lakh-sq-ft multi-client warehouse in Guwahati, the largest such facility in the North-East. However, due to customer changes, consequent drop-in occupancy rates resulted in white space (unutilised space) growing to 7 per cent from the normal trend of 4 per cent.

ML also announced the formation of a JV with Seino Holdings, a Japanese auto logistics company. This JV aims to primarily focus on the business of providing warehousing, trucking and other SCM services to Japanese automotive OEMs and auto ancillary entities.

The launch of an integrated tech stack – LogiOne in FY24 housing most of the segments, coupled with optimisation suite for load and route management, is expected to help ML plan to remove redundancies in various legs of supply chain and enable seamless operations. ML also launched LMD through ONDC – Catapult 4.0 – a start-up incubation programme to co-create innovative solutions for supply chain industry with upcoming start-ups.