Global financial markets tumbled on Monday as fears of a US recession, tensions in West Asia and the unwinding of yen carry trades in Japan spooked investors.

The yen’s appreciation against the dollar has triggered liquidations by several hedge fund players with borrowings in yen.

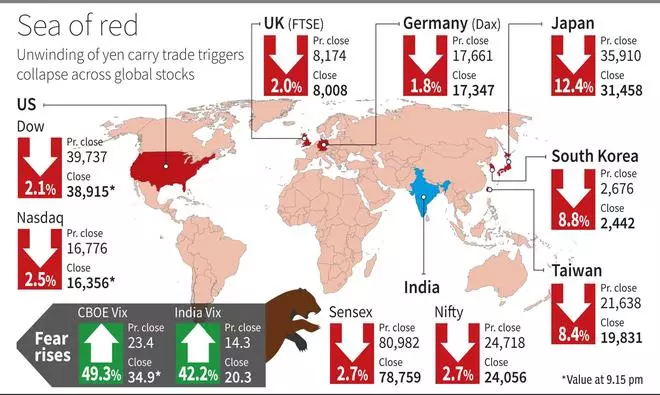

While Indian equities fell over 3 per cent, Asian equity indices traded in a sea of red, with Japan’s Nikkei posting its biggest single-day fall since 1987, down over 12 per cent. Taiwan Weighted and South Korea’s Kospi slid over 8 per cent. European stocks fell, extending last week’s decline.

Global bonds rallied on speculation that the US Federal Reserve and other central banks may cut interest rates more aggressively going forward. Crypto currencies, Bitcoin and Ethereum, slid 13 per cent and 19 per cent, respectively. Crude oil prices, however, remained near eight-month lows.

Non-farm payrolls in the US rose by 114,000 in July, one of the weakest prints since the pandemic. The unemployment rate climbed to 4.3 per cent, the highest in 34 months, triggering a closely-watched recession indicator.

Holding up

After a gap-down opening on Monday, Indian equities held up better than most Asian peers. The Sensex ended 2.74 per cent lower at 78,759, while the Nifty slid 2.68 per cent at 24,055. The Nifty Midcap 100 and Nifty Smallcap 100 indices cracked over 3.5 per cent and 4.5 per cent, respectively. Nifty VIX, a fear index, rose by 42 per cent to 20.37.

Tata Steel, Hindalco, Adani Ports, Tata Motors and ONGC were the top Nifty losers, down more than 5 per cent each. Metal and Realty indices were the key losers.

The rupee fell to an all-time low of 84.05 against the dollar. Yields of 10-year government bonds rose over 1 per cent to 6.971. The HSBC Services PMI came at 60.3, below the forecast of 61.6.

Aniruddha Naha, CIO – Alternatives, PGIM India AMC, said: “The global risks associated with the interest cost rise in Japan and an appreciating yen has led to the unwinding of the carry trade. This will have implications for global and Indian equities as well. Investors need to tone down their return expectations.”

“If the valuations become more reasonable, the current period of turbulence can be used to raise exposure to equities gradually with a 5-7 year view. The long-term outlook remains constructive due to strong fundamentals, government initiatives, and a stable banking sector,” said Vinit Sambre, Head – Equities, DSP Mutual Fund.

Volatility may continue amid multiple global headwinds and the RBI policy, said experts. The US Fed’s rate actions will also be closely watched.

Sandeep Bagla, CEO, TRUST Mutual Fund, said: “Weak employment data is leading to a significant risk-off trade. Market participants are now expecting the US Fed to cut more than 100 bps in the next 5 months, with a high chance of 50 bps cut, on or before the next policy date in September. The slowdown in US is likely to lead to weakening in global prices, which should lower inflationary expectations in India as well. RBI/MPC, in its policy meeting later this week, could take the global developments into account and signal a change in stance, indicating easier monetary conditions in the near future.”