The bone of contention in the recent debate has been the drastic fall in household net financial savings to GDP ratio during 2022-23 on account of a higher borrowing to GDP ratio. In response to our previous article ‘On the Fall in Household Savings’ (The Hindu, April 21, 2024), the Chief Economic Advisor (CEA) to the Government of India has interpreted this trend as a mere shift in the composition of household savings, where households are argued to incur greater borrowing (or reduce net financial savings) solely to finance higher physical savings (investment). In this article, we argue that this interpretation is inconsistent with broad trends and highlight some signs of structural shifts in the Indian economy.

Not a mere change in savings pattern

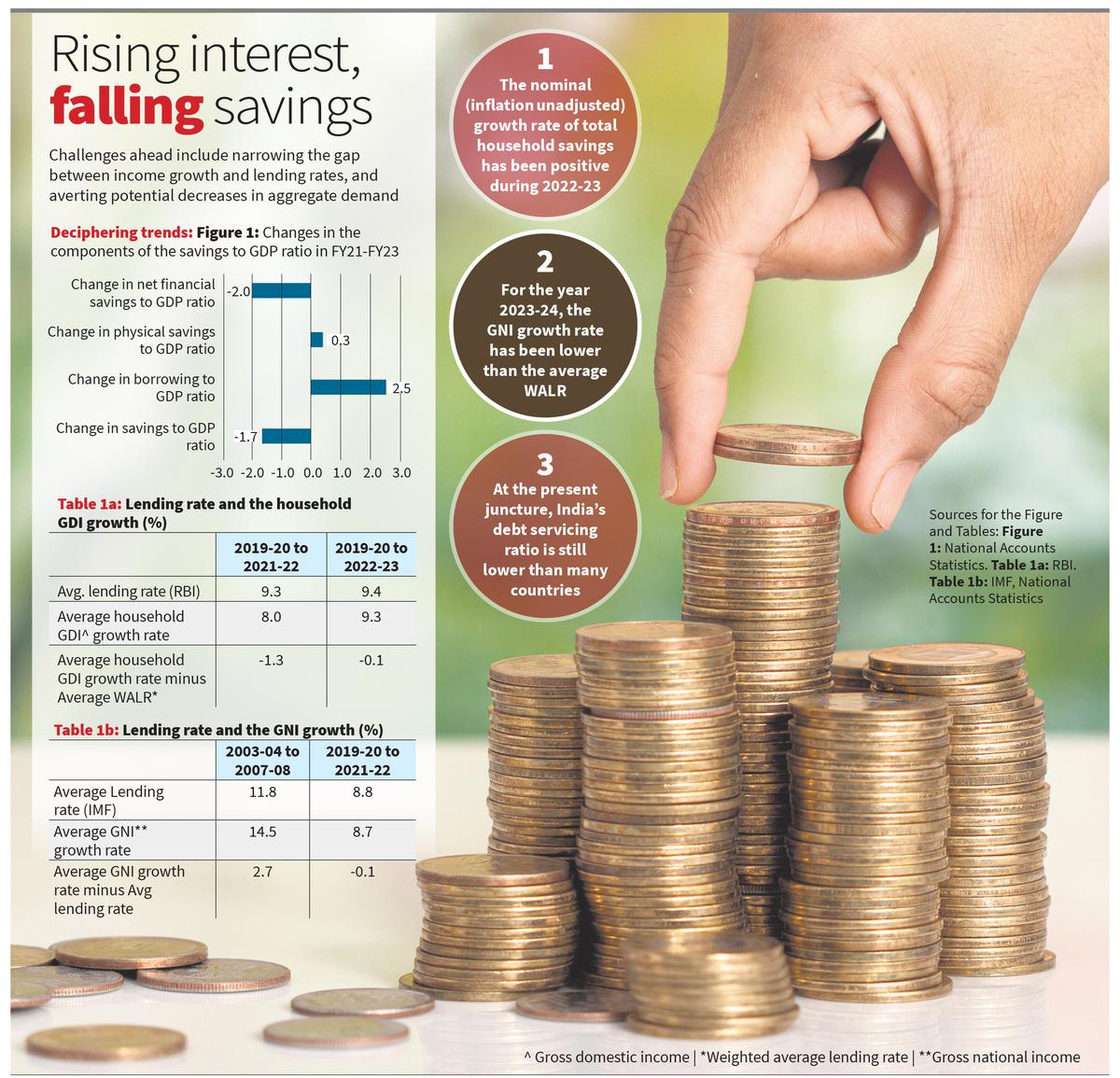

The household savings to GDP ratio is the sum of its net financial savings to GDP ratio, physical savings to GDP ratio and gold and, ornaments. A mere shift in the composition of savings would have kept the overall household savings to GDP ratio unchanged, with lower net financial savings to GDP ratio or higher borrowing to GDP ratio being fully offset by higher physical savings to GDP ratio. Figure 1 shows the extent to which these ratios changed during 2022-23 as compared to 2021-22 and indicates a contrary phenomenon.

The net financial savings to GDP ratio declined by 2.5 percentage points, whereas the physical savings to GDP ratio increased only by 0.3 percentage points. The household borrowing to GDP ratio increased by 2 percentage points, significantly more than the increase in the physical savings to GDP ratio. With the gold savings to GDP ratio remaining largely unchanged, the household savings to GDP ratio declined by 1.7 percentage points. In short, the phenomenon of a household’s higher borrowing to GDP ratio cannot be explained exclusively in terms of change in savings composition. In our last article, we argued that lower net financial savings to GDP ratio and higher borrowing to GDP ratio largely reflected a household’s need to finance greater interest payment commitments at a given income amid higher interest rates and debt-income ratio, leading to an increase in financial distress of the household.

Surprisingly, the CEA’s response is based on the analysis of absolute nominal numbers of household total savings. He argues that the nominal value of a household’s total savings has increased, as the nominal value of physical savings has increased more than the fall in nominal value of net financial savings. However, this trend merely shows that the nominal (inflation unadjusted) growth rate of total household savings has been positive during 2022-23, which has hardly been a topic of contention. A positive nominal growth rate of savings neither addresses the historic fall in net-financial savings to GDP ratio nor refutes our explanation of the higher borrowing to GDP ratio and the phenomenon of greater interest payment burden of the household that we pointed out.

The phenomenon of household’s higher interest payment burdens and debt-income ratio in the post-COVID period, however, brings forth two important questions: Does it reflect a qualitative change in the structure of the macroeconomy in the recent period? If yes, how different are these features from the previous episodes when household borrowing increased?

Signs of structural shift

Since the share of interest payment in household income (interest payment burden) is the product of interest rate and debt-income ratio, any increase in the latter would lead to a greater interest payment-income ratio at a given interest rate. The recent period has been associated with a sharp rise in both these variables. The debt-income ratio of the household can potentially change through two distinct factors. The first factor pertains to a higher net borrowing-income ratio of the household, where net borrowing is the difference between total borrowing and interest payments. Household’s stock of debt would rise at any given level of income if they decide to increase their net borrowing for financing higher investment or consumption.

The second route involves factors that are largely exogenous to the household’s decisions-namely, the interest rate on the outstanding debt and the nominal income growth rate of the household. Any increase in interest rates or reduction in nominal income growth rate increases a household’s debt-income ratio during a particular period. If the growth in interest payments outweighs income growth, the debt-income ratio will continue to grow. Such mechanisms can be described as “Fisher dynamics” following Irving Fisher, who explained the phenomenon of rising debt-income ratio in terms of changes in interest rate and nominal income growth rate.

Starting from the pre-COVID growth slowdown of 2019-20, the Indian economy has typically been characterised by such Fisher dynamics. The post-COVID period has seen a sharp rise in the ratio between nominal debt and nominal income of the household, largely on account of a lower nominal income growth rate. The debt-income ratio as an indicator of household leverage (or repayment capacity) has received scrutiny, particularly after the global financial crisis. Notwithstanding the recent rise in the lending rate that has contributed to the rise in debt-income ratio, the key structural feature that has emerged in the recent period is that the nominal income growth rate has often been lower than the weighted average lending rate. This seems to be the very mechanism by which a household’s interest payment burden and debt-income ratio have increased.

Table 1a shows that the average value of the growth rate of household disposable income has been lower than the weighted average lending rate (WALR) for the period 2019-20 to 2022-23. The average value of the lending rate for this period is constructed from the Reserve Bank of India’s quarterly figures. The household disposable income data is not yet available for 2023-24. However, the gross national income (GNI) growth rate, which is closely associated with the growth rate of household disposable income in the recent period, has recorded lower than the average WALR for this year. These emerging features seem to stand in contrast with previous episodes of high household borrowing, like the period of 2003-04 to 2007-08. While a long run comparison becomes difficult with the indicators used in Table 1a, one can use International Monetary Fund’s lending rate data and the GNI growth rate for the analysis. Table 1b shows that the average GNI growth rate was greater than the average lending rate from 2003-04 to 2007-08. In contrast, the average GNI growth rate was lower than the average lending rate during the period 2019-20 to 2021-22.

Macroeconomic challenges

The comforting news at the present juncture is that India’s debt servicing ratio is still lower than that of many countries. But with the emergence of the Fisher dynamics, there are at least two unique challenges that confront the Indian economy.

The first challenge pertains to decreasing the gap between interest rate and income growth and slowing down the growth of the debt-income ratio of the household. While the level of debt-income ratio presently remains low, frequent episodes of income growth lagging behind the lending rate can quickly push up household’s interest payment burdens.

The second challenge involves stemming the possibility of downward adjustment of aggregate demand amid high interest payment and debt commitments of the household. Such possibilities emerge when households tend to maintain stock-flow norms in debt and wealth management by curtailing their consumption expenditure. The sharp decline in the consumption to GDP ratio in 2023-24 points towards such a possibility. These challenges point towards the need to include an additional macroeconomic policy target to stimulate and support household income growth.

Zico Dasgupta and Srinivas Raghavendra teach economics at Azim Premji University