At the interbank foreign exchange market, the local unit opened at 83.92, then gained ground to touch 83.88, registering a rise of 9 paise from its previous close. File

| Photo Credit: The Hindu

The rupee appreciated 9 paise to 83.88 against the U.S. dollar in morning trade on Thursday (August 29, 2024), supported by the weakness of the American currency in the overseas market and a positive trend in domestic equities.

Forex traders said the market is awaiting cues from the U.S. Gross Domestic Product (GDP) and the U.S. Personal Consumption Expenditure (PCE) inflation data, as this data point is crucial as it could sway the Federal Reserve’s decision on whether to implement a 25 or 50 basis point rate cut at its September meeting.

At the interbank foreign exchange market, the local unit opened at 83.92, then gained ground to touch 83.88, registering a rise of 9 paise from its previous close.

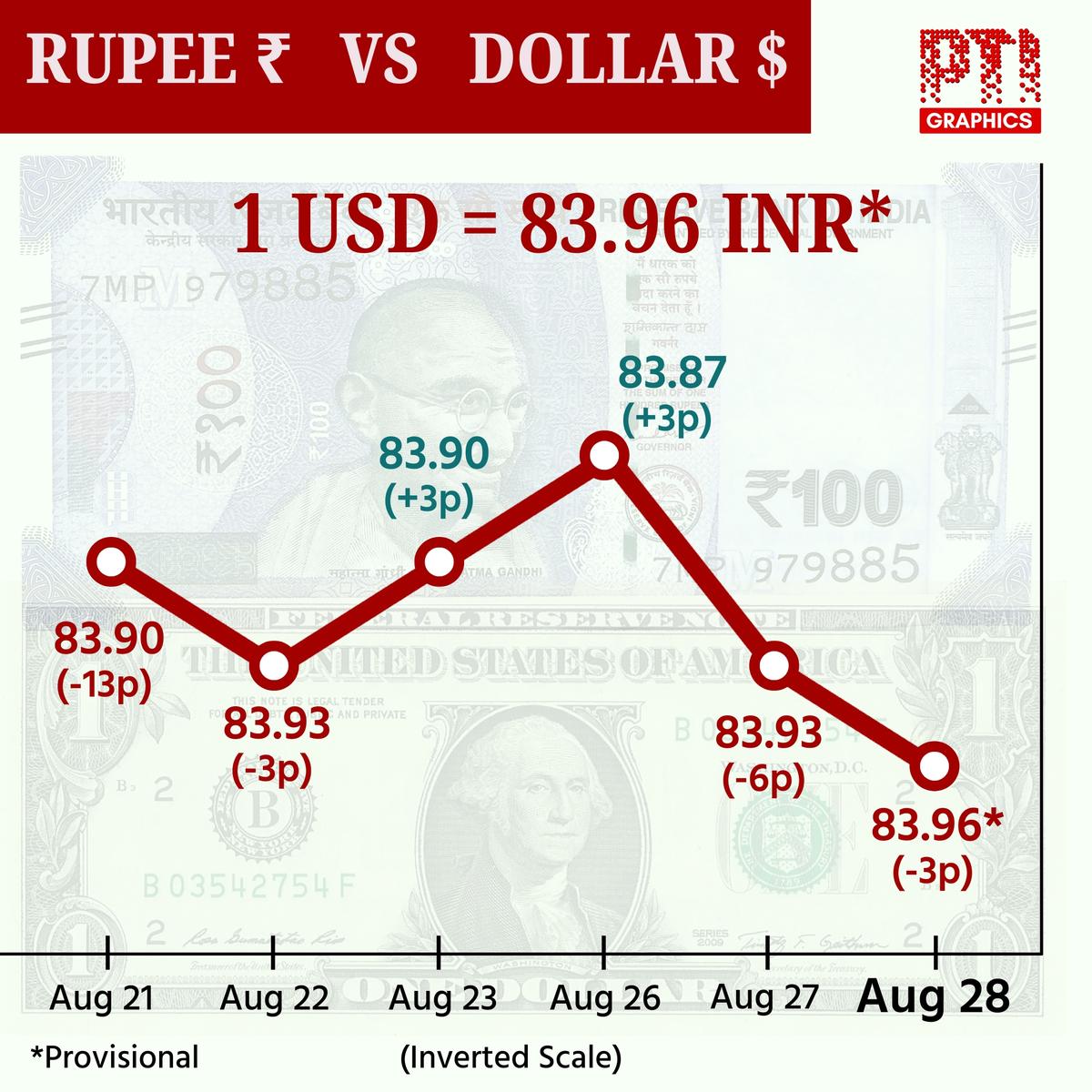

The rupee depreciated 4 paise on Wednesday (August 28, 2024).

| Photo Credit:

PTI

On Wednesday (August 28, 2024), the rupee depreciated 4 paise to close at 83.97 against the American currency.

“The rupee is in the midst of a tug-of-war between positive and negative factors. With the Reserve Bank firmly in control, the rupee is expected to trade within a narrow range in the near term, with the upside likely capped around 83.80 and strong support near 84.05,” CR Forex Advisors MD Amit Pabari said.

“Most Asian currencies were range-bound as the market awaited the U.S. GDP and PCE data, with IDR at 15412, KRW at 1335 and CNH at 7.1278,” said Anil Kumar Bhansali, Head of Treasury and Executive Director Finrex Treasury Advisors LLP.

Meanwhile, the dollar index, which gauges the greenback’s strength against a basket of six currencies, was down 0.16% to 100.92 points.

Brent crude, the international benchmark, gained 0.06% to $78.70 per barrel in futures trade.

In the domestic equity market, the 30-share BSE Sensex advanced 211.91 points, or 0.26%, to 81,997.47 points, while the Nifty was up 52.85 points, or 0.21%, to 25,105.20 points.

Foreign Institutional Investors (FIIs) were net sellers in the capital markets on Wednesday (August 28, 2024), as they offloaded shares worth ₹1,347.53 crore, according to exchange data.